Q2 2025 SMB Market Trends - M&A

- Luke Middendorf

- Jul 22, 2025

- 3 min read

Over the last couple months, I've seen a large increase in calls from sellers who are starting to explore the option of selling their businesses. It's been one of the most active quarters in the last two years, and the activity has continued into the beginning of Q3.

I reviewed four different market reports and, with the help of a few different AI tools and combined with my own insights, I created the summary below.

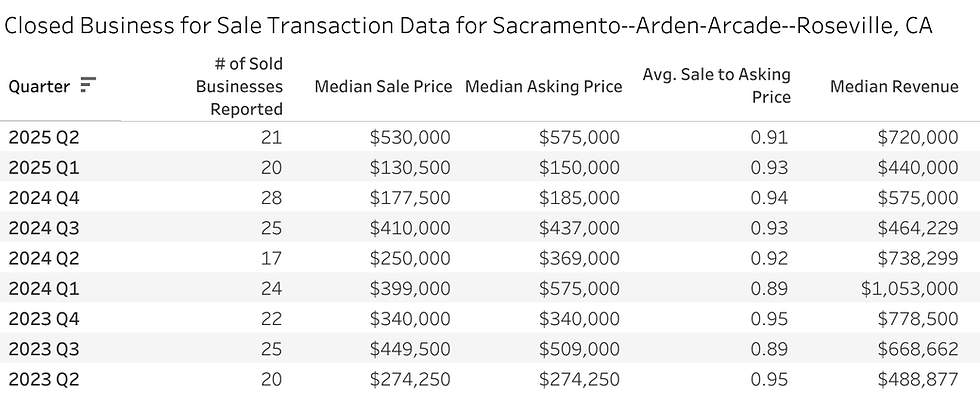

The second quarter of 2025 has brought a mix of resilience and caution across the U.S. small business landscape. For business owners in the Greater Sacramento area considering a sale, understanding current trends in buyer behavior, deal structures, and industry performance can be useful.

Drawing on four leading market reports from Q2, this article provides a data-driven snapshot of what sellers need to know before taking the next step.

1. Transactions Slow, But High-Quality Listings Still Move

According to BizBuySell, 2,342 businesses changed hands nationwide in Q2 2025, a 4% year-over-year decline[1]. Sale prices dropped 6% from last year, and total enterprise value was down 4% year-over-year, reflecting tighter SBA lending conditions and buyer hesitancy driven by tariff concerns. Yet, service and essential retail businesses continued to be in demand.

Sacramento mirrored this national pattern, with closed transactions holding steady in industries such as health services and food retail [1].

2. Tariffs and SBA Lending Rules Reshape Deal Structures

Recent tariff increases and tighter SBA regulations have made deal financing more complex. New SBA rules effective June 1 now limit the use of seller financing in down payments and require standby agreements that delay seller repayment[1]. According to BizBuySell, only 23% of sellers are willing to offer financing, but 62% of buyers expect it to be an option. This disconnect is contributing to longer time-on-market—up 12 days year-over-year[1].

For Sacramento sellers, this means being open to flexible terms or alternative structures may be necessary to complete a transaction. Buyers increasingly seek recession-resistant businesses with strong cash flows and low dependency on imports.

3. Buyer Profiles Evolve: Corporate Refugees Drive Demand

The buyer pool continues to shift. Nearly 45% of buyers are now "corporate refugees"—professionals seeking business ownership after leaving the workforce[1]. This group is targeting reliable, well-run businesses with operational systems in place. In Q2, 73% of buyers preferred recession-resistant industries, especially service-based companies[1]. Most of the individual buyers and PE firms I communicated with in Q2 were looking for the same thing, high quality service based businesses with strong teams in place.

This is good news for Sacramento business owners in industries like healthcare, home services, or logistics. Businesses that consistently generate revenue and are not heavily dependent on their owners have a significant edge.

4. Local Outlook: California Remains a Leader in Sales Volume

California led the nation in small business sales volume in Q2, accounting for 12.3% of total U.S. activity, according to Fiserv[2]. The state saw 2.1% quarter-over-quarter and 7.4% year-over-year sales growth.

Sacramento's performance reflected this trend, with essential service sectors driving stability even as overall transaction volumes modestly declined[2]. Most of the conversations that I've had recently have been with service based businesses.

5. Market Sentiment: Cautious Optimism, But Time is Valuable

Small business confidence is improving, with 73% of owners reporting that they are comfortable with their cash flow. [3] However, fewer are expecting revenue growth compared to last year, and concerns over compliance, staffing, and inflation remain high[3].

According to PNC's Q2 economic outlook, consumer confidence has declined to its lowest level since the pandemic, while small business optimism—though still elevated—has slipped from late 2024 levels[4].

The uncertainty surrounding tariffs and inflationary pressure is causing both consumers and businesses to pull back on spending and investment decisions.

What does this mean for buyers and sellers?

Despite the cooling pace of transactions, serious buyers remain active—especially for recession-resilient, well-run businesses.

For Sacramento owners considering an exit, preparation is more important than timing. Take the time to evaluate your business and understand how the core drivers of value impact the selling price that the market will bear when preparing your business for sale.

Ready to explore your options? Schedule a confidential consultation today and take the first step toward a successful sale.

Sources

.png)

Comments